how do you calculate cash flow to creditors

The statement of cash flows acts as a bridge between the. Cash inflows from the sale of stock.

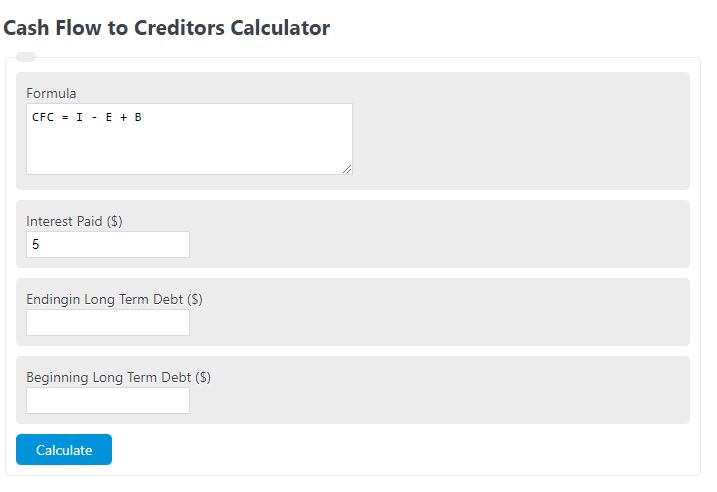

Cash Flow To Creditors Calculator Calculator Academy

Cash inflows from the issuance of debt instruments.

. You know youll be on the hook for 2400 each month. Cash flow to creditors Interest paid New long-term debt Cash flow to creditors Interest paid Long-term debt end Long-term debt beg Cash flow to creditors 24120 190000 171000 Cash flow to creditors 5120 The cash flow to stockholders is a little trickier in this problem. It is noteworthy that this amount will equal cash flows to creditors plus cash flows to stockholders which shows how you can draw a line between this and the balance represented by the accounting equation.

This is a simple example of calculating cash flow. Lets say your rent is 2000 and your monthly credit card payment is 400. Cash Flows from Operating Activities.

Net Cash Flow from Financing Activities. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. It is noteworthy that this amount will equal cash flows to creditors plus cash flows to stockholders which shows how you can draw a line between this and the balance represented by the accounting equation.

Here are some examples of how to calculate cash flow from assets. Tightening credit to reduce investments made in accounts receivable. 1 net income 2 plus non-cash expenses 3.

Operating Cash Flow Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business in a specific time period. Then the Cash and Cash Equivalent at the End of the Period will be 360000 140000 which equals to 500000. Johnson Paper Company is a family company that sells office supplies.

Cash outflows from the repurchase of stock. The formula for each company will be different but the basic structure always includes three components. However the family wants to sell the company so they can retire.

Calculation of net cash flow can be done as follows. Cash flow to creditors can help you comprehend the condition of your company and whether you have the ability to borrow money from investors at times of debt. As an example assume your company made 150000 in.

The cash flow to creditors is. We can use the above equation to calculate the same. But maybe you had to pay back a relative who loaned you 300 to.

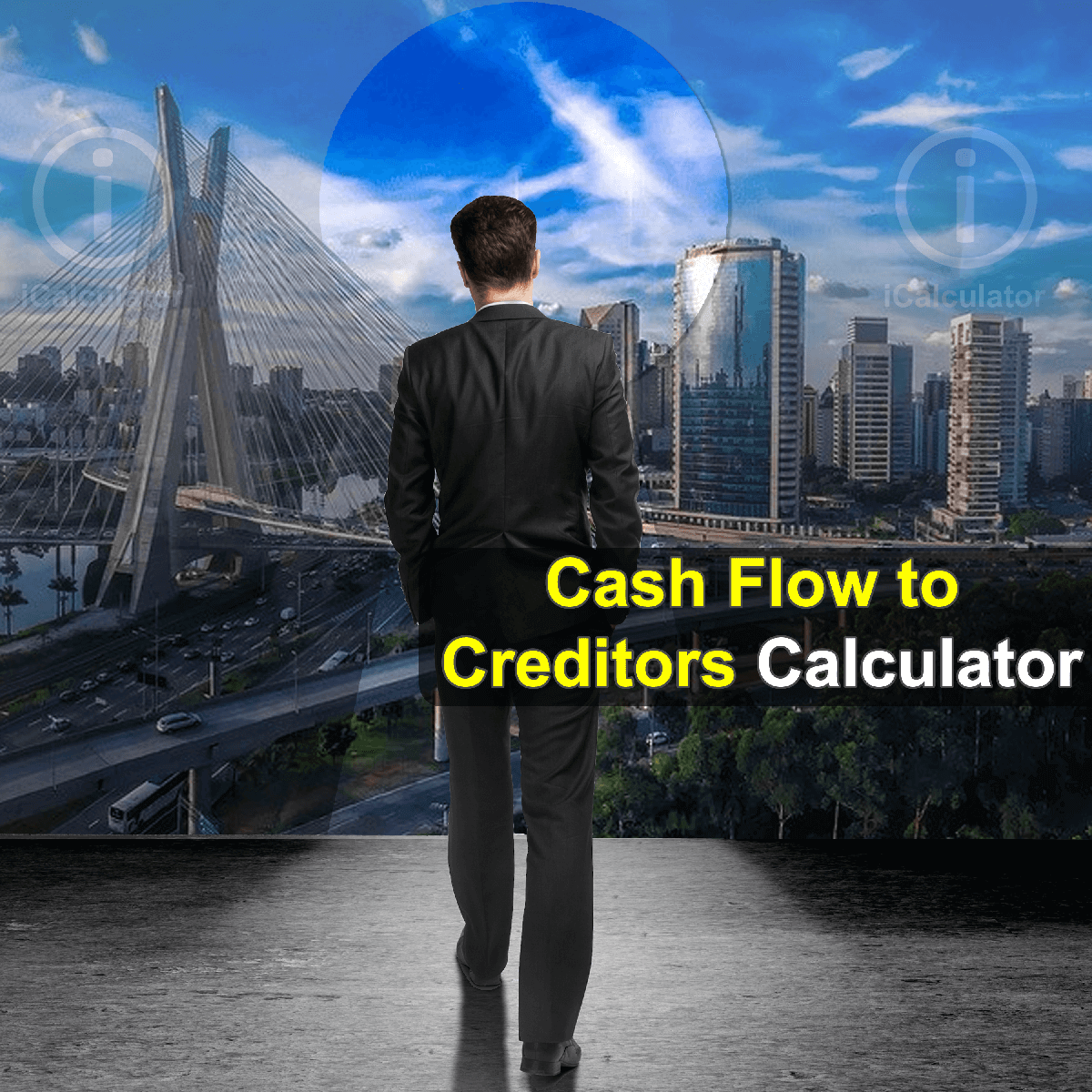

Cash outflows and cash inflows for business entity purchases and sales. Since the income statement uses accrual-based accounting. This equation reflects cash flow you generate from periodic profit while adjusting for the fact that depreciation is a non-cash expense and taxes create a cash outflow.

Cash flow from assets represents all cash flows that are recorded by the company that relate to assets. The Operating Cash Flow Formula is used to calculate how much cash a company generated or consumed from its operating activities in a period and is displayed on the Cash Flow Statement. The basic formula for operating cash flow is earnings before interest and taxes or EBIT plus depreciation and minus taxes.

Lets assume that the Net Increase in Cash and Cash Equivalent is 360000 and the Cash Equivalent at the beginning of the period is 140000. In addition this accounting helps companies to access their liabilities and assets and what kind of financial need they are in. Net Cash Flow from Investing Activities.

One of the simplest ways to calculate the average collection period is to start with receivables turnover which is calculated by dividing sales over accounts receivable to. The calculation of cash flow for financing activities includes the following items. Cash outflows for the repayment of debt.

Example of calculating cash flow from assets. A positive cash flow means that even in terms of a minor. The more free cash flow a company has the more it can allocate to dividends.

Is calculated by starting with net income which comes from the bottom of the income statement. Net Cash Flow 100 million 50 million 30 million. Cash Flow to Creditors cf C Formula and Calculations.

Cash Flow What Is It And What Is It For Efficy

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Creditors Modano

Payg Tax Withholding Reporting Melbourne Cashflow Management Melbourne Bookkeeping Services Bookkeeping Cash Flow

Modules Guide Creditors Financial Statement Impacts Modano

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Accounting Basics Accounting Education

Cash Flow To Creditors Calculator Finance Calculator Icalculator

Introduction To Accounting Accounting Education Information Managerial Accounting

Sinking Fund A Fund To Help You Sink Your Debt Budgeting Money Sinking Funds Finance Investing

Readability Financial Statement Analysis Financial Statement Financial Analysis

Blank Income Statement Template Fresh Blank In E Statement And Balance Sheet Aoteamedia Statement Template Income Statement Mission Statement Template

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Accounting Basics Accounting Education

Debtors Creditors Control Accounts Accounting Basics Financial Peace University Accounting

Timing Of Debtor And Creditor Payments Calculation In Calxa

Blank Income Statement Template Fresh Blank In E Statement And Balance Sheet Aoteamedia Statement Template Income Statement Mission Statement Template